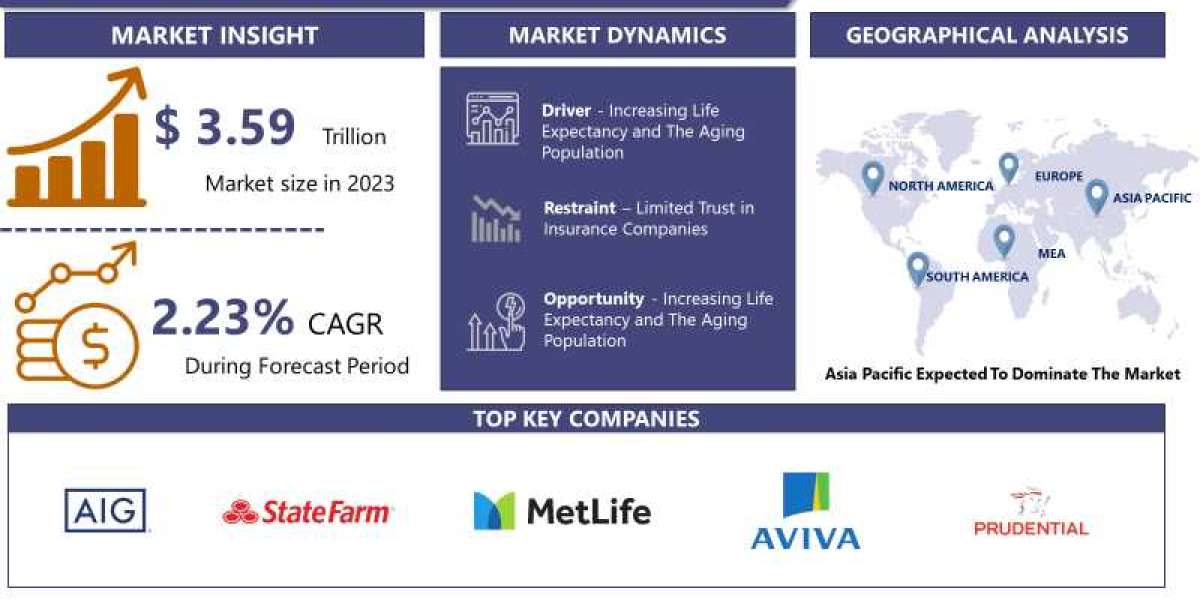

The life insurance market encompasses the buying, selling, and distribution of life insurance policies. Life insurance provides financial protection to individuals and their families by paying out a predetermined sum of money upon the insured person's death. This payout, known as the death benefit, is typically used to cover expenses such as funeral costs, outstanding debts, mortgage payments, and to provide financial support for dependents.Life insurance policies are typically sold by insurance companies or financial institutions, either directly to consumers or through intermediaries such as insurance agents or brokers. These policies can vary in terms of coverage, premium payments, and benefits offered, providing individuals with options to tailor their coverage to their specific needs and financial goals.

The life insurance market is influenced by various factors, including demographic trends, economic conditions, regulatory changes, and advancements in technology. Insurers constantly innovate to develop new products and services that meet the evolving needs of consumers and adapt to changing market conditions.

This FREE sample includes data points, ranging from trend analyses to estimates and forecasts. See for yourself

https://introspectivemarketresearch.com/request/15077

Top investment pockets

- American International Group (AIG) (US)

- State Farm Insurance (US)

- MetLife (US)

- Aviva (UK)

- Prudential (UK)

- Standard Life Assurance (UK)

- Munich Re Group (Germany)

- Allianz (Germany)

- Assicurazioni Generali (Italy)

- CNP Assurances (France)

- AXA (France)

- Swiss Reinsurance (Switzerland)

- Zurich Financial Services (Switzerland)

- ACE Group (Switzerland)

- Aegon (Netherlands)

- Nippon Life Insurance (Japan)

- Asahi Mutual Life Insurance (Japan)

- Sumitomo Life Insurance (Japan)

- Dai-ichi Mutual Life Insurance (Japan)

- Meiji Yasuda Life Insurance Company (Japan)

- Asian Life Insurance Company (Nepal)

- WanaArtha Life (Indonesia)

- AIA Group Limited (China)

- China Life Insurance Company Limited (China)

- China Ping An Life Insurance Company Limited (China)

- IndiaFirst Life (India), and Other Major Players.

The Report on Platform As A Market provides detailed analysis of segments in the market based on:

By Type

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Endowment Policies

- Retirement Plans

By Demographics

- Age

- Income Level

- Occupation

By Distribution Channel

- Insurance Agents/Brokers

- Direct Sales

- Bancassurance

- Employer-Sponsored Plans

By Region

- North America (U.S., Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

- Middle East Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Key Issues Addressed by Life Insurance Market Economy: It's very significant to have segmentation investigation to find out the essential factors of industry in a sector of growth and maturation. The report offers well summarized and details regarding every department of expansion, development, production, demand, types, application of the particular product which will be handy for the player highlight and to focus.

Will you have any questions about this report? Please contact us on:

https://introspectivemarketresearch.com/inquiry/15077

Key Life Insurance Statistics

Here are some key life insurance statistics that provide insights into the industry's size, trends, and consumer behavior:

- Market Size

- Ownership Rates

- Policy Types:.

- Coverage Amount

- Demographics

- Reasons for Purchase:

- Employer-Sponsored Coverage:

- Consumer Preferences

These statistics provide valuable insights into the state of the life insurance industry, including consumer behavior, preferences, and market trends.

Access Report Summary with Detailed TOC at :

https://introspectivemarketresearch.com/checkout/?user=1_sid=15077

The COVID-19 (coronavirus) pandemic is affecting society and the total market throughout the entire globe. The impact of this outbreak is affecting the supply series in addition to growing every day. Even the COVID-19 crisis is creating uncertainty in the stock exchange, massive slowing of supply chain, falling business confidence, and increasing dread among the consumer segments. The total effect of this pandemic is affecting several industries' production process. This record on Life Insurance Market' provides the research about the impact on COVID-19 on several different industry segments and country markets. The reports also showcase forecast and market trends, factoring COVID-19 Situation's effect.

What Are the Different Types of Life Insurance?

Americans typically buy several types of life insurance policies, each offering different features and benefits. Some of the most common types of life insurance purchased by Americans include:

- Term Life Insurance: This type of life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to beneficiaries if the insured person passes away during the term of the policy. Term life insurance is often more affordable than permanent life insurance and is commonly chosen by individuals looking for temporary coverage to protect against financial obligations like mortgages or education expenses.

- Whole Life Insurance: Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured person, as long as premiums are paid. It offers a guaranteed death benefit and also accumulates cash value over time, which policyholders can access through loans or withdrawals. Whole life insurance premiums remain fixed for the life of the policy, providing stability and predictability in financial planning.

- Universal Life Insurance: Universal life insurance is another form of permanent life insurance that offers flexibility in premium payments and death benefits. Policyholders can adjust the amount and timing of premium payments and have the potential to earn interest on cash value accumulation based on market performance. Universal life insurance provides lifelong coverage and offers the opportunity for policyholders to build cash value over time.

- Variable Life Insurance: Variable life insurance is a type of permanent life insurance that allows policyholders to invest their cash value in various investment options such as stocks, bonds, or mutual funds. The cash value and death benefit of variable life insurance policies can fluctuate based on the performance of the underlying investment options, offering the potential for higher returns but also greater risk.

- Indexed Universal Life Insurance: Indexed universal life insurance combines features of universal life insurance with the opportunity to earn interest based on the performance of a market index, such as the SP 500. Policyholders can allocate their cash value to a fixed account or an indexed account, providing potential for growth while offering downside protection. Indexed universal life insurance policies typically offer flexible premiums and death benefits, allowing policyholders to adjust coverage to meet their changing needs.

These are some of the primary types of life insurance policies purchased by Americans, each with its own features, benefits, and considerations. The choice of life insurance depends on individual financial goals, risk tolerance, and coverage needs. It's essential for individuals to carefully evaluate their options and consult with a financial advisor or insurance professional to determine the most suitable type of life insurance for their circumstances.

About Us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Get in Touch with Us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1 773 382 1049

Email: sales@introspectivemarketresearch.com