IoT for Finance refers to the application of IoT technologies, including sensors, connected devices, data analytics, and cloud computing, within the financial services industry to transform traditional banking, insurance, investment, and other financial operations. It encompasses a range of use cases and solutions such as smart banking, predictive analytics, fraud detection, asset tracking, personalized customer experiences, risk management, and compliance monitoring, enabling financial institutions to adapt to changing market dynamics, meet evolving customer expectations, and stay competitive in the digital era.

The IoT for Finance Market encompasses the realm of financial services that harnesses Internet of Things (IoT) technologies. Its purpose is to boost operational efficiency, enhance customer experiences, and fuel innovation within the financial sector. This involves deploying interconnected devices, sensors, and advanced data analytics to gather real-time data, streamline processes, and deliver tailored financial solutions to both businesses and consumers.

Get Sample Request Report Here:

https://introspectivemarketresearch.com/request/15068

Introspective Market Research specializes in delivering comprehensive market research studies that provide valuable insights and strategic guidance to businesses worldwide. Our reports draw data from diverse and solid primary and secondary sources. By utilizing industry-standard tools like Porter's Five Forces Analysis, SWOT Analysis, and Price Trend Analysis, we enhance the comprehensiveness of our evaluations.

Top Key Players Covered in the IoT for Finance Market

IBM (U.S.), Microsoft Corporation (U.S.), Oracle Corporation (U.S.), Intel Corporation (U.S.), Dell Technologies (U.S.), CGI Inc. (Canada), Hewlett Packard Enterprise (U.S.), SAP SE (Germany), Finastra (UK), Capgemini SE (France), Atos SE (France), Accenture plc (Ireland), Fujitsu Limited (Japan), Hitachi, Ltd. (Japan)

Get Discount for This Report:

https://introspectivemarketresearch.com/discount/15068

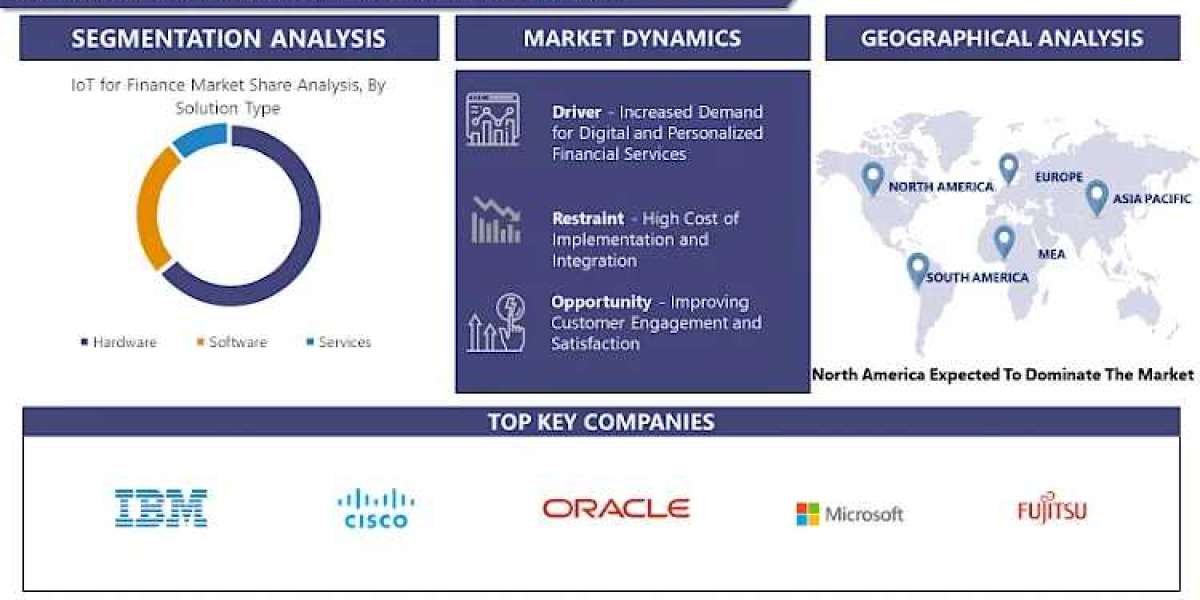

Segmentation Analysis of IoT for Finance Market

By Solution Type

- Hardware

- Software

- Services

By Application

- Payments

- Fraud Detection

- Risk Management

- Asset Management

By End- User

- Banking

- Insurance

By Region

- North America (U.S., Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, U.K., France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

- Middle East Africa (Turkey, Saudi Arabia, Bahrain, Kuwait, Qatar, UAE, Israel, South Africa)

IoT for Finance Market Insights:

- Market Size and Forecast: The global IoT for Finance market is experiencing rapid growth, driven by increasing demand from banks, insurance companies, investment firms, and other financial institutions looking to leverage IoT technologies to transform their operations, innovate their products and services, and enhance customer engagement and satisfaction. North America leads the market due to the presence of a large number of financial institutions, advanced IT infrastructure, high adoption rates of IoT technologies, and growing investments in fintech innovation. However, the Asia-Pacific region is emerging as a key market, fueled by expanding financial services sector, rising internet penetration, increasing smartphone adoption, and growing demand for digital banking and payment solutions in emerging economies.

- Competitive Landscape: The IoT for Finance market is highly competitive, with several key players, including IBM, Cisco Systems, SAP, Oracle, Microsoft, and Intel, among others, competing based on product offerings, technological innovation, strategic partnerships, and market presence. Companies are focusing on developing innovative IoT solutions tailored to the unique needs and challenges of the financial services industry, enhancing interoperability, scalability, and security, and establishing strategic collaborations with financial institutions, technology providers, and ecosystem partners to expand market reach, drive adoption, and achieve competitive differentiation.

Acquire the Report:

https://introspectivemarketresearch.com/checkout/?user=1_sid=15068

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assist our clients grow and have a successful impact on the market. Our team at IMR is ready to assist our clients flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, specialized in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1049